What Is Vertical Analysis? A Detailed Guide for Finance Students

Understanding financial documents, like balance sheets, income statements, and cash flow statements, is a very daunting task. However, understanding them is also important because the managers, accountants, and financial advisors of a business want to know how well a company is performing. So, how can you understand such documents with ease? Yes, you have guessed it right. With the help of vertical analysis of financial documents, you can have a good idea of a company’s financial position over the years.

However, it has been seen that many financial students face difficulty in performing vertical analysis of financial documents. It is mainly because they find it difficult to grab the idea of this analysis and calculate different percentages. So, considering this problem for students, today’s post is going to serve as a guide for all financial students. There will be a description of this analysis, its importance, the method of doing it, and its pros and cons. So, let’s get started with today’s discussion.

What do you mean by vertical analysis?

Vertical analysis is nothing but an accounting tool that allows you to do a proportional analysis of the financial statements of a company. How is this analysis differs from others? It is different in the way it is performed. Every item on the financial statement is calculated as a percentage of another item. For example, you analyse an income statement of a company. Now, every item on this statement will be analysed as a percentage of the gross sales.

Similarly, in the case of the balance sheet, you make every entry on the basis of total assets, not on the base of total currency. Performing a vertical analysis on a company’s cash flow statement means analysing every cash that comes in and goes out of the company relative to its total cash inflows. So, this is what this analysis is.

Why is it important to perform vertical analysis?

Performing this analysis is important in many ways. However, a brief description of the major ways is as follows:

- This analysis provides insights into a company’s historical financial performance.

- It helps in the evaluation of the relationship between and among different accounts

- It helps the accountants in the identification of unusual items in the financial statements

- Most important of all, this analysis, in conjunction with various accounting periods, allows the students to identify financial trends.

- It can also be used to compare the performance of one company with similar companies in the same industry.

How to perform the vertical analysis?

In vertical analysis, the relationship between different variables is measured. In this method of analysing the financial statements of a company, you express each item as a percentage of the total. However, a brief description of the three steps used in this analysis is as follows:

- The first step is the assumption step. In this step, you assume one thing as 100%. In the case of the income statement, you consider sales as 100%, and in the case of balance, the total assets are assumed to be 100%. So, do this as the first step.

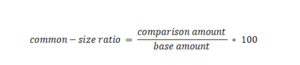

- The second step is about doing some mathematical work and performing the analysis in actuality. It involves calculating the percentage of each item in the financial statement by dividing it by the assumed 100%. The formula that you use most in step 2 is as follows:

- The last step is about interpreting the results of the analysis. Based on the analysis, you conclude the company’s financial condition over the years and now.

Hence, these are the three steps that are the base of this analysis. Due to the complexities of analyzing financial statements, students, most of the time, find it difficult to run this analysis. If you are also facing such difficulty, you should go and hire a dissertation writing service. Such a service has qualified and certified finance specialists. They can help you out.

Advantages of vertical analysis for financial students

After reading the information above, you have got a good idea of this analysis, its importance, and how to perform it. As promised at the start of the article, now is the time to shed some light on its advantages. Hence, a brief description of the four major advantages of vertical analysis is as follows:

Simplifies things to understand

This analysis simplifies things to enhance the understanding of the relationship of items on the balance sheet. The reason is that they are expressed in the form of a percentage, so it is for the readers to understand. The company’s management can use those values to set goals.

More influential tool

This analysis is a relatively more potent tool than its counterpart, i.e., horizontal analysis. This is because this analysis shows the relative changes in a company’s financial position over a certain period of time. The horizontal analysis does not do so.

Comparison with industry trends

As this analysis analyses the company’s financial statements and tells about the company’s financial condition, it also enables the company’s managers to compare their performance with the industry trends. If it is above than industry, well and good. If it is not, this analysis helps them take effective decisions.

Highly effective method

This method of analyzing the financial statements of a company is highly effective when comparing two companies of different sizes. For example, normally, comparing a $1 billion company and a $500,000 company is very tricky. However, it is the vertical analysis that enables the accountants to make this possible and create common-size measures.

Conclusion

Conclusively, a vertical analysis is an excellent tool to unearth what is happening in the financial statements of a company. However, the main disadvantage of this method is that it cannot answer “why.” Some major advantages of this method are listed above, and you should also read the steps to perform this very important financial analysis.